10 Best Credit Card Processing Services in 2023

The Biggest Comparison of Credit Card Processing Companies Ever Done

Finding the right payment processor for your business isn’t easy – after all, it’s an industry filled with aggressive marketing and not-so-transparent fees. That’s why we decided to look past the flashy deals and share the facts on pricing, features, security, and more, so that you can make an informed decision.

Credit card processing companies are at an advantage. They know that credit card processing is no longer optional for businesses, big or small. This has emboldened many to adopt some unsavory business practices. It’s not uncommon for a sales agent to sweet-talk a business into a great-sounding deal, only to laden them with exorbitant hidden fees.

Sadly, credit card processing companies are almost impossible to compare on the surface, as many offer no information on their site besides a few empty promises about how they are definitely your cheapest choice. These difficulties have caused many businesses to just accept a poor deal and service – but you don’t have to.

We spent hundreds of hours putting together a list of the top 10 credit card processing companies operating today. To perform the most detailed comparison possible, we compiled thousands of merchant reviews, extensively compared features and pricing, and even tested the trustworthiness of each provider’s sales process for ourselves.

With our comparison, you’ll be able to minimize your processing fees, while benefiting from some truly great features. Read through our findings below to find the right credit card processor for your businesses.

-

- Promises to meet or beat your current processor’s rates

- 24/7 technical support, entire department available to help with chargebacks

- Friendly to high-risk merchants

Leaders Merchant Services promises to try to at least meet, but in many cases beat, the rates of your previous processor. You’ll be asked to provide your two most recent monthly processing statements and the sales agent will try to offer a better deal overall.

This makes Leaders Merchant Services a nice option if you’re already with a payment processor – you can use your current rates as a starting point on the negotiation table.

While merchants looking for their first payment processor won’t have existing rates to beat, they’ll still benefit from Leaders’ industry low processing rates, quick approval, and impressive features such as customer loyalty programs, business loans, and cash advances.

As for the actual payment processing services, Leaders Merchant Services offers reliable solutions for both in-person and online transactions, from all-in-one terminals to iPad and Android card readers that allow you to accept payments wherever your business takes you. Its terminals integrate with a range of e-commerce software.

Leaders also offers 24/7 technical support, with an entire department dedicated to helping you effectively dispute chargebacks. If you’re a mid or high-risk merchant, this will likely save you a lot of money (and headaches) over time.

More on Leaders Merchant Services

Visit Leaders Merchant Services > Read our Leaders Merchant Services review -

- Pass on your processing fees to the customer

- Feature-filled e-commerce platform

- Extra fraud protection for high-risk merchants

ProMerchant offers a great deal to the right business: quick approval, next-day payouts, and low monthly plan fees. The standout feature is its Zero Cost Processing plan, which is only available for retail businesses and restaurants. This plan allows you to pass credit card processing fees to your customers via a surcharge.

This means you get 100% of every payment you take – even interchange fees can be passed on to the customer. Because of this, ProMerchant better fits businesses with high sales volumes, who’d get the most out of saving on transaction fees. Keep in mind that you’ll still have to pay a monthly subscription, and the surcharge will slightly raise your prices.

If your business isn’t in the retail or food industry, ProMerchant offers an interchange plus plan. This plan is also monthly with no cancellation fees and competitively priced transaction fees. Whichever plan you choose, your business will benefit from ProMerchant’s exceptional customer support.

-

- Interchange plus and membership plans tailored to each client’s needs

- Monthly contracts with no cancellation fees

- Fast payouts with option for same-day funding

If you’re looking for a payment processor that will tailor its fees and features to your business’s unique needs, PAYARC is your best option. Its client-centered approach, multiple payment models, and useful built-in tools make PAYARC suitable for most businesses, whatever their industry or size.

PAYARC offers membership and interchange-plus plans together with a cash discount program that allows merchants to pass processing costs to their customers. These plans are all competitively priced and come with technology-driven features such as built-in invoicing, enhanced data reports, and real-time sales and payment tracking.

Unlike other processors, PAYARC also makes it easy for businesses with an international clientele to securely accept payments for products/services they sell to clients worldwide. Another standout feature is special reduced rates for nonprofits and charities processing contributions.

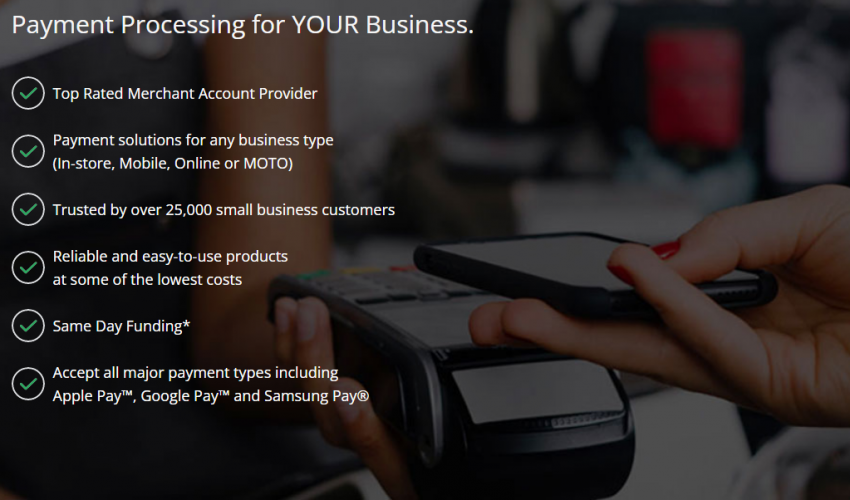

-

- Option for same-day payouts

- Offer your customers branded gift and loyalty cards

- Begin taking payments in just a few hours

Flagship Merchant Services offers same-day funding to your merchant account, regardless of whether the sales were made in-person or online. Most merchants will leave you waiting over 24 hours to have access to your earned funds, so this is a welcome add-on.

Same-day funding allows you to more flexibly manage the financial difficulties of running a business – you can more easily meet monetary obligations, ensure your inventory remains well-stocked, and so on. The same-day funding service does cost extra, but it’ll be well worth it for many businesses.

Flagship Merchant Services is also refreshingly easy to get started with – onboarding is straightforward and your account can be approved in just a few hours. That said, Flagship isn’t the most transparent processor when it comes to pricing. I’d recommend negotiating for a simple interchange-plus plan for the best deal.

More on Flagship Merchant Services

Visit Flagship Merchant Services > Read our Flagship Merchant Services review -

- Free Clover Mini POS terminal

- Easily sell subscriptions through the Vindica management platform

- Complementary training

Like Stax, CreditCardProcessing.com ditches percentage-based markups in favor of a simple monthly subscription plus flat transaction fee. While this transaction fee is quite high on its lower-volume plans, high-volume businesses get some of the cheapest transaction fees I’ve seen.

Sweetening the deal even further is the free Clover Mini terminal you get with the High Volume plan. This offers responsive software with tons of useful functionality. You can manage inventory, staff scheduling, and more, straight from the terminal. I rarely see Clover terminals offered for free, so this is a major perk of CreditCardProcessing.com’s High Volume plan.

In addition, every plan gives you free access to the premium Vindica service, which makes it easy to manage and optimize the selling of subscription services, thanks to detailed analytics and a user-friendly platform. Vindica also attempts to fix any failed payments automatically, helping to keep your customers happy and your revenue stable.

More on CreditCardProcessing.com

Visit CreditCardProcessing.com > Read our CreditCardProcessing.com review -

- Monthly subscription model with no markup

- Feature-filled e-commerce platform

- Your choice of a free POS terminal

If you’re tired of credit card processors taking a sizable cut of every transaction, you’ll like Stax’s simple monthly payment model – you just pay a monthly subscription with no percentage-based markup. What’s more, it’s a beginner-friendly platform that’s easy to set up and start selling with, even if you have no prior experience.

While there is a small flat fee per transaction in addition to the wholesale interchange rates (which isn’t mentioned on the site), businesses can save with this payment model. If you’re earning over $8,000 per month, you may pay less than with a traditional processor that uses a percentage markup on every transaction.

Stax is a particularly good option for online selling, with an e-commerce platform that allows you to create a custom shopping cart in a few clicks. It also provides easy integrations for popular e-commerce and accounting platforms, though you’ll have to pay for some integrations. Its flexible API even lets you implement your own checkout system and create custom integrations.

-

- No monthly or hidden fees

- Next- and same-day payouts as standard

- Zero liability protection against unauthorized transactions

Small to medium-sized enterprises will find a lot to love about Chase Payment Solutions. With no mandatory contracts, monthly fees, or hidden costs and simple interchange-plus pricing, this credit card processor is designed to keep your overhead low. You won’t miss out on any core features, either. Your merchant account comes with a range of software to help you grow your business, including a customer buying habits tracker.

Chase also stands out for providing rapid access to your funds. Next-day payouts come as standard, and Chase banking customers even get same-day payouts. You may have to pay a small monthly fee for your bank account, but this can be waived if you meet certain criteria that are fairly accessible for mid-sized businesses.

Please note that you will need to buy all the required hardware directly from Chase’s limited POS selection, which comprises proprietary devices that may not be reprogrammable in the future. The good news is that Chase frequently offers promotions on its device range, allowing you to obtain equipment for your premises (or field technicians) at a discounted price.

More on Chase Payment Solutions

Visit Chase Payment Solutions > Read our Chase Payment Solutions review -

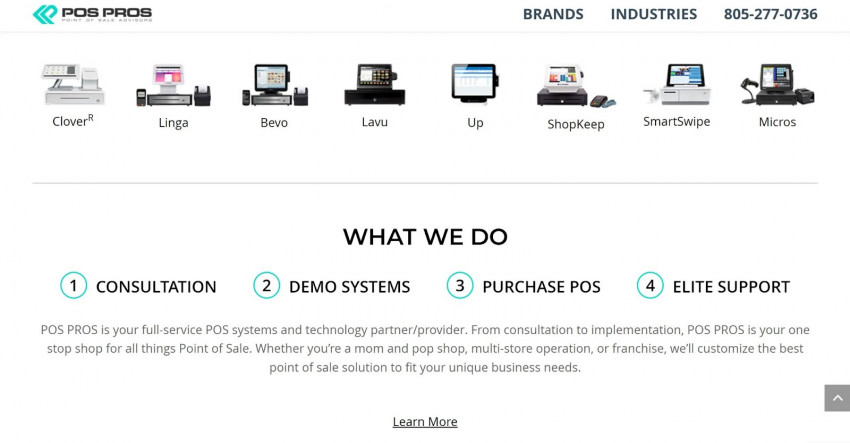

- Industry-specific POS hardware and software

- Fast payout times for in-person and online transactions

- No contracts or termination fees

While it’s at the bottom of our list, POS Pros’ industry-specific approach to POS solutions offers a lot to businesses that rely mostly on in-person transactions. Restaurants, retailers, hotels, and healthcare practitioners can all benefit from this approach, which takes into account not just your business type, but also its size and unique processing needs.

During an initial consultation, a POS Pros specialist will recommend several point-of-sale equipment options. You’ll then be able to test the interface and features of each POS system during a free virtual demo. This personalized approach can help both new and established businesses avoid buying the wrong equipment.

While POS Pros offers interchange plus, tiered pricing, and cash discount plans for both brick-and-mortar and e-commerce merchants, it doesn’t post pricing and fees on its website. While this quote-only approach has its advantages, it can make it more difficult if you’re comparing multiple processors to determine which is your best option.

-

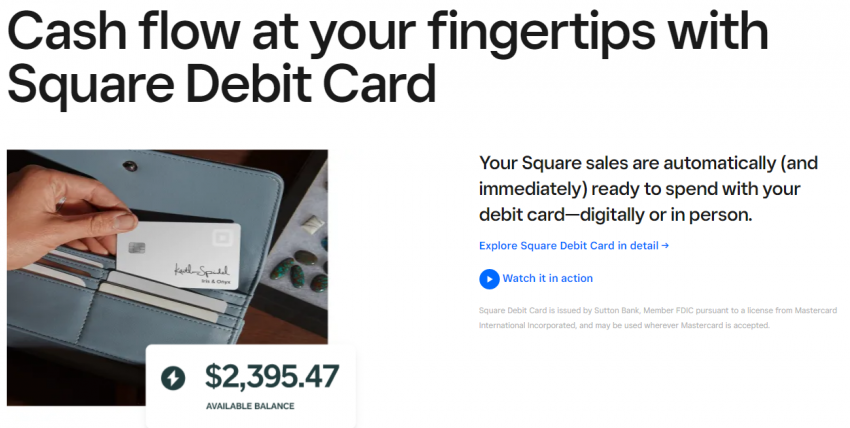

- Immediate access to funds through a small business checking account

- Free support in launching your online store

- Easy and fast sign-up – no long approval process

Square is a good solution for startups and small businesses. First of all, you can be selling with Square in just two minutes – there’s no lengthy vetting process to go through. If you’ve left setting up a payment processor until the last minute, this is one of the few processors that won’t delay the launch of your new business.

In addition, Square allows you to easily create a small business checking account, and gives you access to your earned funds instantly. Whenever you make a sale, you will be able to use that revenue without any waiting around. I can’t overstate how useful this can be to a new business.

Square offers transparent pricing which boils down to a percentage markup and a flat transaction fee, with different rates for online and in-person sales. These rates offer decent value to small businesses, but high-volume businesses can get a better deal with a payment processor offering a monthly subscription model.

-

- Build and host your own store with Helcim

- No contracts – cancel at any time without paying a fee

- User-friendly customer and inventory management tools

Starting an e-commerce business isn’t easy. Not only do you have to select a good payment processor, you’ll also have to find a web hosting company that provides decent performance and store development tools. Helcim handles this for you by offering free web hosting and a store builder alongside its payment processing services.

This is great if you’re selling online, but the picture isn’t quite as rosy if you take payments in a brick-and-mortar store. Helcim only integrates with a limited range of third-party POS hardware, which doesn’t include any third-party card terminals. This means you’re forced to purchase its proprietary card reader outright.

Still, if you’re happy to use Helcim’s hardware, this all-in-one solution definitely makes things easier. Helcim’s platform is super user-friendly – every aspect of it, from store and checkout creation, to customer & inventory management, requires zero code and can be controlled with a few clicks. Best of all, Helcim doesn’t lock you into a contract – you can cancel at any time without paying a fee.

How Do We Evaluate Credit Card Processors?

Unlike other review sites, we at Website Planet believe you deserve to know more than just the surface-level details of each credit card processor. To get at the truth beyond the marketing, here are the measures we take to evaluate the payment processors we review.Features

Obviously you need your credit card processor to process payments, but this isn’t all a good processor should offer. The best credit card processors also make running your business and managing your finances far easier by giving you management tools, detailed analytics, and integratable e-commerce and POS solutions. We separately research the features listed by every payment processor to get at the reality behind all the marketing jargon. This allows us to determine what, if anything, really stands. For example, Leaders Merchant Services’ e-commerce tools and integrations are among the most versatile in the business – even more so than those offered by more expensive payment processors.Ease of Use

Most businesses simply want something that works, and works well. No one wants to get trapped in hours of setup and coding just to get their payment processor to integrate with their backend. After all, time is valuable – the best credit card processors can be set up in minutes. That’s why we evaluate every payment processor on its overall ease of use. Will a beginner have difficulty setting things up? Are there guides or training available? How user-friendly is the platform? These are just some of the questions we ask when considering how easy to use a platform really is.Compliance and Security

Security is a priority. If your payment processor cannot ensure PCI-compliance, your business could face heavy fines and class-action lawsuits. A data breach can easily bring an otherwise successful business to its knees, and customers need to be able to trust you if they’re going to hand over their money and data. That’s why we ensure that every credit card processor we review is PCI-compliant. We also check overall security standards, whether data breaches occurred in the past, and more. Additional protections against fraud and chargebacks are always a bonus.Pricing

Credit card processors have a reputation for smuggling non-disclosed fees into their contracts. To make matters worse, many payment processors completely hide their rates, forcing you to ring their sales line. This immediately puts you at a disadvantage, as the trained sales agent has all the information while you have none. We cut through this obscurity to give you more precise details on what you can expect to pay. That way, you can make an informed decision. We also reward credit card processors who offer transparent pricing information, which is something we’d love to see become the norm.Support

If the finances of your business are at stake, there had better be a responsive support team to help whenever there’s an issue. You can find plenty of horror stories online where crucial funds were withheld from merchants and the credit card processor’s support team just didn’t seem to care. Testing the support team of each credit card processor is an important part of all our reviews. We call the sales team ourselves to find out whether they give honest and helpful information, and we also evaluate the responsiveness and availability of the technical support team.FAQ

Which credit card processor is best?

This depends on many factors, such as your industry, transaction volume, average transaction amount, and more. That said, Leaders Merchant Services is an excellent choice for most businesses, offering reliable low-cost interchange plus processing, innovative POS solutions, and a meet-or-beat guarantee. Otherwise, you can check out our comparison of the top 10 credit card processors above to get a feel for which processor might be a good fit for your business. For more information on a particular one, be sure to check out its detailed review.What is the largest credit card processor in the US?

The largest payment processors in the US tend to be banks, such as Bank of America and First Data. However, this doesn’t mean that they are good options. They tend to charge high processing fees and offer little to no features that can help manage your business and finances. All of the credit card processors above offer better value.What are typical credit card processing fees?

Most businesses will pay 1.5% – 4.5% of every cashless transaction in processing fees. The exact percentage will vary depending on the interchange rate charged by card-issuing banks, as well as the fees charged by the credit card processor.What is the fastest credit card processor?

Square offers the fastest access to your funds through its small business checking account. That said, it’s not a great choice for businesses with a large transaction volume. In such cases, I’d recommend Flagship Merchant Services, which offers same-day funding along with better rates for larger businesses.So happy you liked it!